PRE REPORT (3/27/24) March 28 Planting Intentions & Quarterly Stocks (noon release) Cheat sheet:

Posted 3/25/2024

This is an incredible analysis teeing off what is expected to be a very volatile & shortened week of trading at the CME for the grain markets.

Kevin Van Trump is a purebred trader from the pits of Chicago. He trades just about everything, but his passion is sharing his knowledge with the farming community. In my opinion, he gives the most thorough and unbiased (he’s not trying to sell you a strategy or get you to open an account with him) recommendations in the agricultural space. Head to his website to sign up for a Free Trial now www.vantrumpreport.com

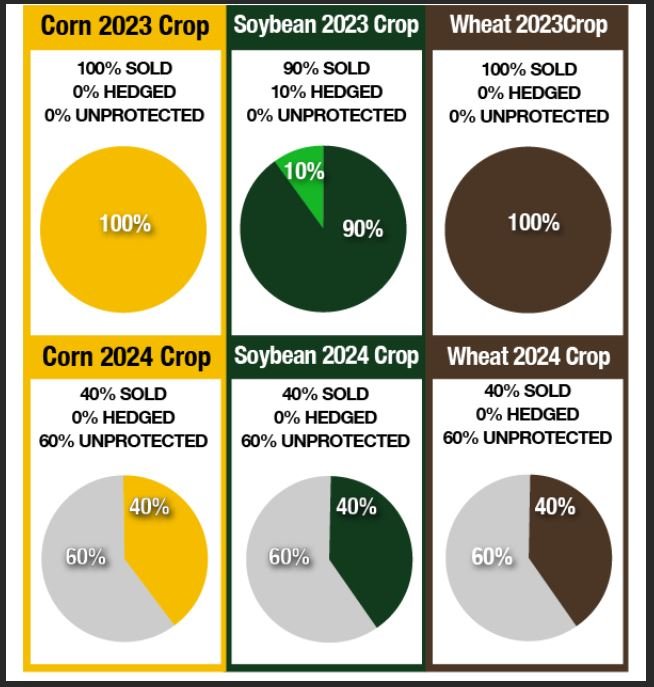

Corn prices chopped around mostly sideways with little overall movement last week. This week, however, traders are bracing for what could be a wild ending to holiday shortened market. The USDA is scheduled to release two big reports on Thursday. The report being talked and debated the most is the Prospective Planting Report. The USDA is currently forecasting 91 million acres of new-crop corn will be planted in the US this year vs. 94.6 million planted last year vs. 88.2 planted in 2022 vs. 92.9 planted in 2021. This years acreage number will be a big data point for the trade. Anything much over +91 million acres will have the bears talking about a +3.0 billion bushel US ending stock number, which could heavily weigh on prices into and throughout the growing season. I personally want to argue and believe the new-crop corn acreage number is going to be sub-91 million, but most sources inside the trade are thinking the cooperative weather this winter and in the early spring has allowed for enough field work to be done that the corn acres are going to be planted. I certainly understand the bears new-crop acreage argument, I'm just hoping they are wrong. The USDA will also be releasing its March 1 Quarterly Stocks report on Thursday. Most sources inside the trade are looking for March 1 Quarterly Stocks to be the highest we have seen in the past five years and up +12% to +15% compared to last year. Bottom line, from my perspective, the trade seems to be looking for bearish numbers from the USDA. How much of that is already baked into the current price, I'm not really sure. What makes things even more interesting is the fact these reports fall on a holiday-shortened trade week, with the market closed on Friday. We also have the reports falling on the end-of-the-month and end-of-the-quarter, which could have some sizable meaning for the funds and may impact how hey play their hand. As a producer, you want to use the next few days ahead of the reports to make necessary adjustments and too get buckled in. I have to imagine the short couple of hours the trade will have to adjust following Thursday's USDA reports and ahead of the extended holiday weekend could be a crazy and wild ride.

Soybean prices are up +40 cents in the past month but are still down over -$2.00 per bushel from the highs posted less-than six-months ago. Bulls argue that the USDA still needs to cut Brazil's new-crop production, which is now over +70% harvested, by another -5 to -10 MMTs. Bears argue that regardless of the possible downward adjustment to Brazil, total new-crop production for all of South America is still going to be +10 to +15 MMTs larger than last year. In addition, traders here at home are looking for US new-crop soybean acres to be higher by +3 to +4 million this year compared to last. The problem is Chinese demand has been somewhat suspect, especially in regard to larger US purchases, so the trade is nervous about the increase in total production without China having a growing appetite for more US beans. Yes, overall US domestic demand has been strong and looks like it will continue to show good growth but how much heavy lifting can it do on its own merit? Keep in mind, total US demand for 2023-24 marketing year is down over -300 million bushels compared to just two years ago (2021-22 marketing year). The more than -400 million bushel drop in US exports seems like it has been the real market killer, along with the uptick in SAM and US new-crop production. The trade will be eager to see what the USDA has to say in its Prospective Planting and Quarterly Stocks reports on Thursday. The USDA is currently forecasting that 87.5 million (trade thinking more like 86.5 million) new-crop soybean acres will be planted in 2024 vs. 83.6 million planted last year vs. 87.5 million planted in 2022 vs. 87.2 million planted in 2021. As for March 1 Quarterly Stocks, there's talk inside the trade the number could be up 9% to 10% compared to last year. Net-net, it feels like the trade is somewhat prepared for a few bearish numbers. Bulls are just hoping the numbers come in less bearish than anticipated... Stay tuned!

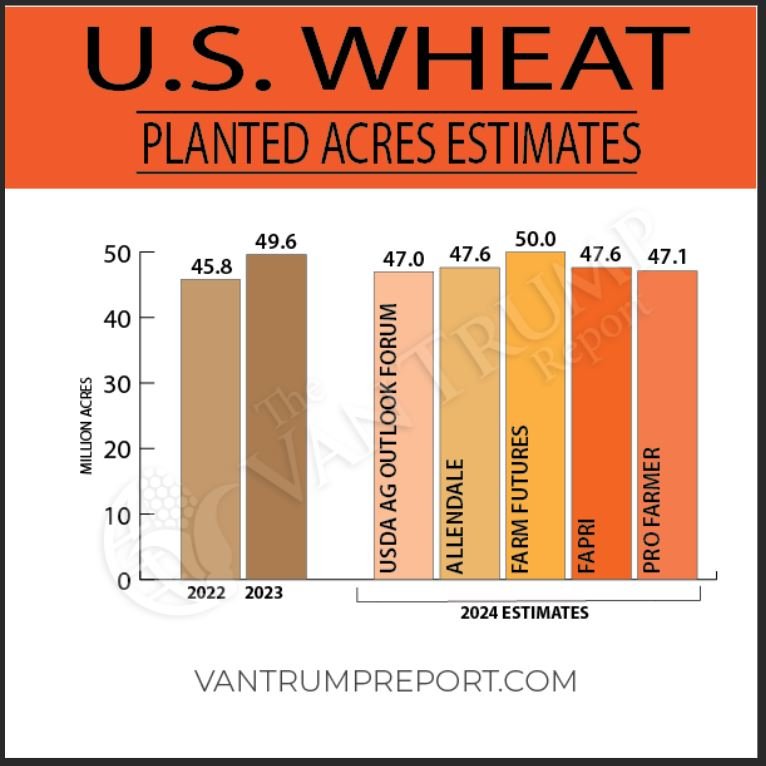

Wheat bulls were happy to see the market gain over +20 cents last week. Unfortunately, prices are still down over -$1.00 from highs posted less-than six-months ago and down over -$2.50 per bushel from the highs posted less-than nine-months ago. Technically, it's been a song of lower-highs and lower-lows for the past two years. Keep in mind, SRW prices peaked at just over $14.25 two years ago back in March of 2022. Here we are now almost -$9.00 per bushel lower and wondering if the market has finally found a bottom. As both a spec and a producer, I am hoping the answer is yes. I am holding some out-of-the money JUL24 SRW calls (that are back to being profitable) and I would like to make some more new-crop sales sooner rather than later. The problem is cheap Russian wheat continues to weigh on the trade. In the same breath, sources inside Russia continue to raise their new-crop wheat production numbers to new all-time record highs which makes it tough for the bulls to gain much sustained momentum to the upside. It also doesn't help to have the Chinese canceling purchases of US wheat. The good news is, those bearish cards have now been flipped over and perhaps fully digested by the trade. As my Pop's would often say, "It's always darkest before dawn." I feel like the lights have been turned off on this market for an extended period. I am hoping some war and weather wild-cards might soon provide a little stronger bounce back to the upside. As for the USDA's upcoming reports on Thursday, the trade seems to be looking for March 1 Quarterly Stocks to come +12% to 15% higher than last year. As for new-crop wheat acres, most seem to be thinking US spring wheat acres will be down -200,000 to -400,000 from last year and US total wheat acres will be lower by -2.2 to -2.5 million compared to last year.

Sales recommendations up to 3/25/2024